tl;dr

The eurozone's business activity hit a 16-month high in September, driven by Germany's resilience and a services sector rebound, but France's stagnation and weak demand raise doubts about the recovery's sustainability.

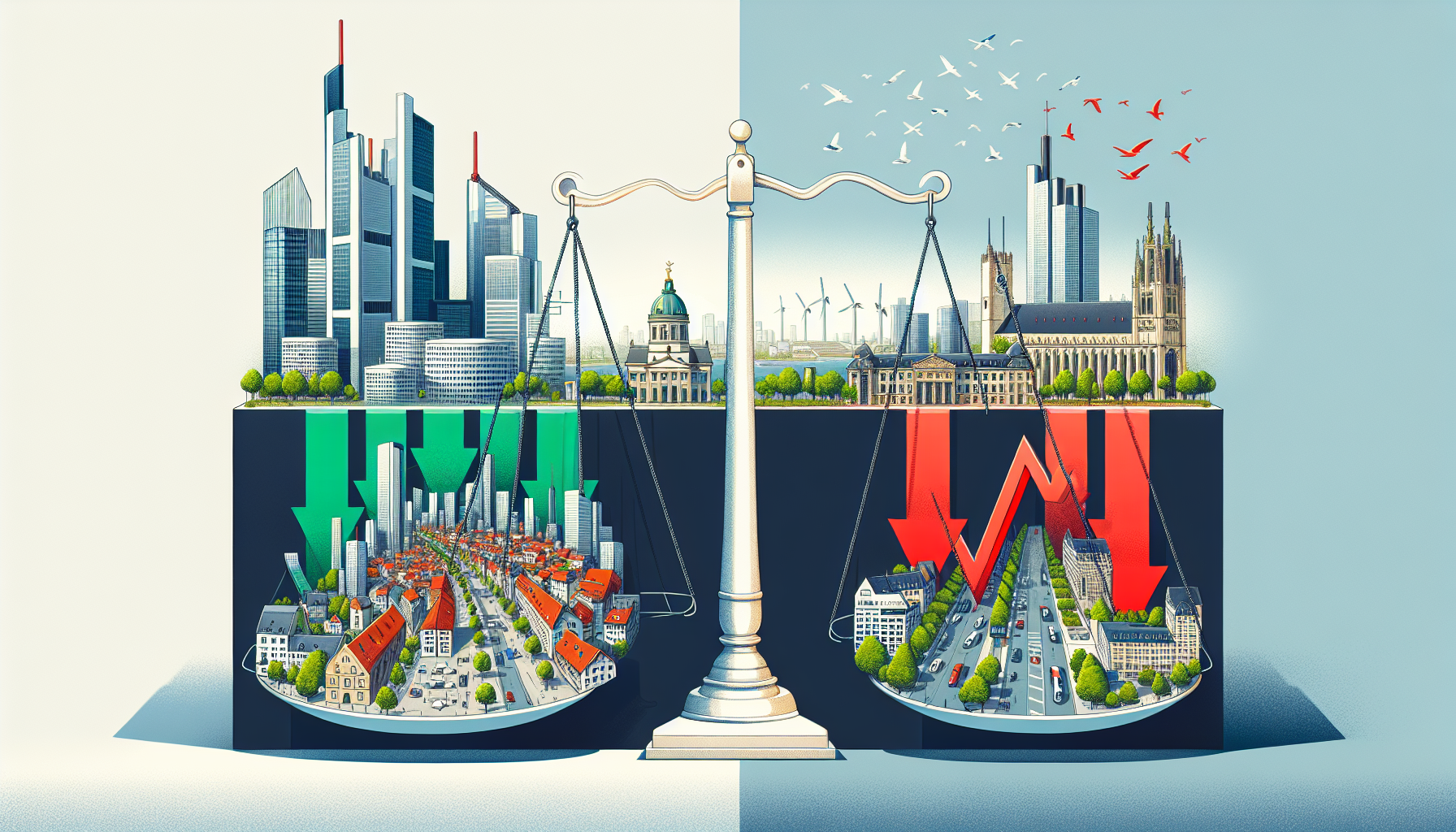

**Eurozone Growth Surges, but a Divided Recovery Raises Questions**

The eurozone’s business activity hit a 16-month high in September, fueled by a resilient services sector and a surprising rebound in Germany. Yet, the region’s economic picture remains deeply divided, with France’s struggles and waning demand casting a shadow over the recovery.

The HCOB Flash Eurozone Composite Purchasing Managers’ Index (PMI) climbed to 51.2 in September, just above the 51.0 reading in August. While the index remains in expansion territory (above 50), the slight gain—missing expectations of 51.1—signals caution. This marks the ninth consecutive month of growth, but the lack of momentum in new orders (falling to 50.0) hints at underlying fragility.

**Germany’s Strength vs. France’s Stagnation**

Germany, the eurozone’s economic engine, posted a 16-month high PMI of 52.4, outpacing forecasts of 50.6. The country’s manufacturing and services sectors both improved, with factories reporting increased output and service providers seeing a surge in demand. “The improvement in recent months is solely attributable to a rise in the German index,” said Ralph Solveen of Commerzbank, noting that other eurozone nations showed no such progress.

France, by contrast, posted its worst reading in nine months, with its PMI dropping to 48.4—a contraction for the 13th consecutive month. Political turmoil, including massive protests over budget cuts and pension reforms, has eroded business confidence. “The French economy appears to be mirroring this sense of instability,” said Bert Colijn of ING. The services sector, once a bright spot, also contracted, while manufacturing declined at the fastest pace since April.

**Services Drive Growth, Manufacturing Stalls**

The services sector was the eurozone’s main growth engine, with its PMI jumping to 51.4—its best reading in nine months. This surge offset weakness in manufacturing, which fell to 49.5, marking a return to contraction. Factories reported declining orders and reduced output, while service companies, though hiring, did so at the slowest pace in seven months.

Job numbers remained flat in September, ending six months of steady hiring. Companies cited a lack of new business as the primary reason for holding back on recruitment.

**Price Pressures Ease, but Inflation Fears Persist**

Inflationary pressures softened in September. Manufacturing costs fell for the first time in three months, and service firms reported slower price increases. The services output price PMI dropped to 52.7, just above its 2019 average, suggesting a potential easing of domestic inflation. However, the ECB remains cautious. The central bank kept interest rates steady this month, signaling it has likely finished its rate-cutting cycle.

**A Fragile Balance**

The eurozone’s growth is a tale of two economies. Germany’s resilience and the services sector’s momentum provide a glimmer of hope, but France’s stagnation and weak demand for new orders raise doubts about the sustainability of the recovery. As the region navigates political unrest, shifting consumer behavior, and lingering inflation, the question remains: Can this modest expansion hold, or will the eurozone’s divide deepen?

For investors and policymakers, the mixed signals underscore a delicate tightrope walk. While the eurozone avoids a full-blown slump, the path forward remains uncertain. What do you think? Will Germany’s strength be enough to pull the region forward, or will France’s struggles derail the recovery?